Getting My Paypal Business Loan To Work

Wiki Article

The Definitive Guide to Paypal Business Loan

Table of ContentsThe 25-Second Trick For Paypal Business Loan10 Easy Facts About Paypal Business Loan Described10 Simple Techniques For Paypal Business Loan3 Simple Techniques For Paypal Business LoanWhat Does Paypal Business Loan Do?Some Known Facts About Paypal Business Loan.4 Easy Facts About Paypal Business Loan ShownHow Paypal Business Loan can Save You Time, Stress, and Money.Some Known Details About Paypal Business Loan

You will certainly be representing your business as well as mentioning your situation as to why the lending institution should consider you worthwhile of a loan. You will need to have a strong company strategy and also a thorough explanation of how you will utilize the cash.Do not forget to dress properly and also to perfect your join in individual and also in creating, simply in instance they call for an online lending application. The authorities in the financial sector intend to see numbers, but they are human (primarily) as well as can be won over by a good personality as well as method with words.

Paypal Business Loan Can Be Fun For Anyone

If you have a cash flow of $5000 per month and your financing payments would certainly be $2500, your DSCR is 2 because your lending payment is half your income. The majority of lending institutions desire a DSCR rating greater than 1. 5. Unnecessary to state, the higher your DSCR, the much better your opportunities of getting the car loan.

Some Ideas on Paypal Business Loan You Should Know

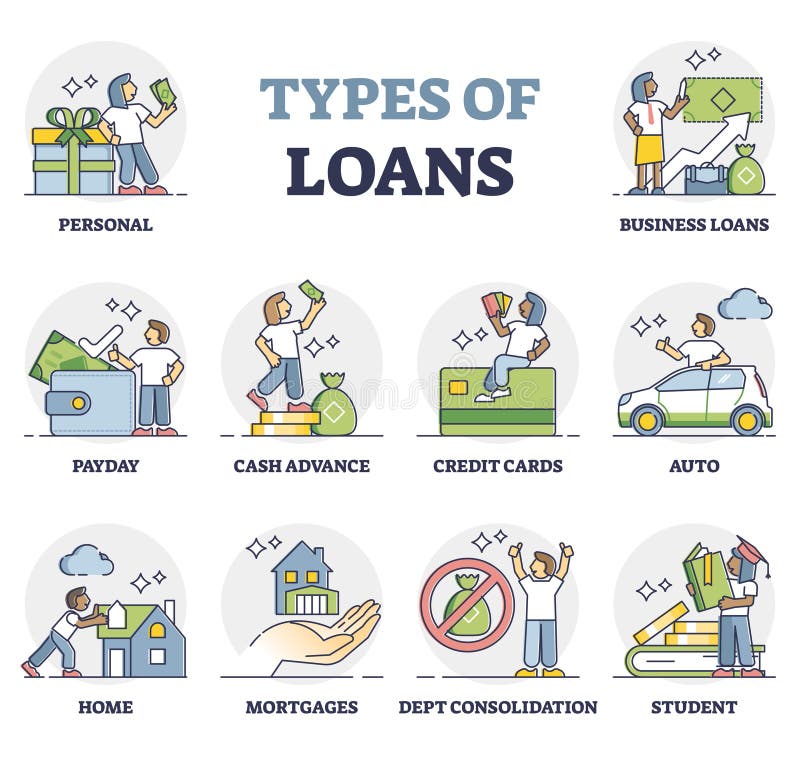

Not only does this show that you think enough in your very own service to put your assets on the line, yet in some cases the business does not have sufficient collateral to cover the loan amount. If you desire others to risk their financial resources for your business, you ought to prepare to risk your own. PayPal Business Loan.This is particularly real when you are considering the various sorts of fundings offered to you. Right here are numerous of one of the most typical kinds of little service loans: The united state Small company Management created this funding program to assist produce more company chances in the country as well as, consequently, promote a much better economic situation.

Some Known Incorrect Statements About Paypal Business Loan

These financings are normally secured by company properties. A working resources lending is a short-term lending to assist the organization keep afloat when capital is short.However, you need to be aware that you will be expected to pay the lending back in full rather quickly (usually less than year). This kind of funding is comparable to a personal bank card, but it can be found in the kind of a separate checking account for your business.

Top Guidelines Of Paypal Business Loan

It is extremely flexible however usually comes with a greater rate of find more info interest. When click over here now looking around for a bank loan, there are a few different things that you need to keep your eyes and ears open for. Allow's damage down these elements of a finance as well as just how the different sorts of finances rank for these aspects.The longer you have to wait to obtain your funding, the worse your economic circumstance can obtain. If you are in dire demand of money to keep your organization afloat, the speed of financing need to be among the top priorities in your option of funding. The fastest approach of business funding is a seller cash loan.

Paypal Business Loan for Dummies

As superb of a deal as SBA loans are, this is where they fail. SBA lendings can take months to process. This can damage a local business that needs quick financing. There's no such point as a free car loan. * Nevertheless, there are some fundings that will certainly cost you much less cash over time.

The Facts About Paypal Business Loan Revealed

Large financial institutions typically have more stringent requirements, making it harder to secure financing. They can usually use better rates, and also you'll understand that you are obtaining from a relied on source. Tiny banks might be more ready to provide to services in their home town because they know the business as well as the business proprietor.In addition to, it can be difficult to take into consideration how difficult as well as prolonged the settlement of these car read this loans can come to be. No one wants to gather organization financial debt. If you are wary concerning committing to a small service finance, you do have some business financing options that are a little bit less complicated to safeguard (and also sometimes extra cost-effective).

Not known Facts About Paypal Business Loan

You additionally have the flexibility to borrow when you require from the permission and pre-pay when you have surplus funds. Right here, you pay interest just on the amount utilised. Apart from these groups of service financings, we provide personal fundings to professionals such as financings for businesswomen, hired accountants and also doctors. PayPal Business Loan.

Rumored Buzz on Paypal Business Loan

The fast answer is "Really important". When it involves small company lending, owners and also their companies are viewed as one-and- the- exact same. Local business owners typically put in a great deal of impact over their business so lenders placed a heavy focus on the proprietor's credit scores profile. The better your credit rating as well as credit history (FICO), the much better the opportunities you will certainly obtain a financing; and, likely on much better terms.Report this wiki page